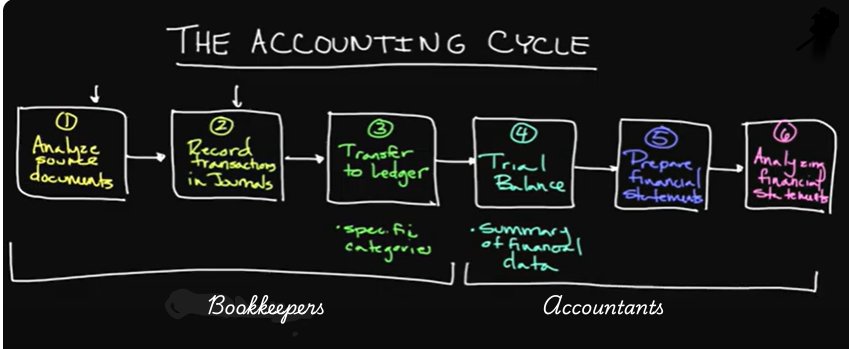

Bookkeeping plays a significant role in the accounting cycle as delineated by the Generally Accepted Accounting Principles (GAAP) accounting cycle. The accounting cycle is a structured procedure for recording, summarizing, and reporting financial transactions per GAAP. By following the GAAP accounting cycle, companies can ensure that their financial statements are accurate, consistent, and reliable, thereby fostering transparency and trust among stakeholders. Its last three steps are the proper domain for accountants: trial balance, preparation of financial statements, and analysis of financial ratios; whilst the first two steps, preceded by analysis of source documents and consideration of adjusting entries, are the domain for bookkeepers: record transactions in journals and posting the relevant transactions to a ledger.

Analyse source documents

The “Analyse Source Documents” step involves reviewing, categorizing, verifying, documenting, and preparing original financial documents for journal entry. These source documents include invoices, receipts, bank statements, checks, purchase orders, and payroll records. Verification checks for errors, omissions, and inconsistencies to ensure authenticity and accuracy. Categorization identifies the type of transaction and affected accounts. Documentation notes key details like dates, amounts, payees, and descriptions, ensuring valid and accurate transactions are recorded, thus maintaining the integrity of the accounting process.Consider Adjusting Entries

However, some financial transactions may not have a physical source document but must still be recorded in journal entries. So, consider “adjusting entries” or “non-source transactions,” also known as “internal transactions.” These involve estimates, accruals, internal adjustments, or non-cash transactions that don’t originate from a physical source document. Adjusting entries typically come under the headings of depreciation, amortization, accrued expenses, accrued revenue, internal transfers, bad debt write-offs, asset adjustments, or reallocations.Record transactions in journals

The formal GAAP accounting cycle begins with the recording of financial transactions as journal entries in the general journal, using the double-entry system, ensuring accuracy and balance. Each transaction affects at least two accounts, with one debited and the other credited, maintaining the equation Assets = Liabilities + Equity. Entries include the transaction date, affected accounts, amounts, and a brief description. Accrual accounting ensures revenues and expenses are recognized when earned or incurred, not when cash is exchanged. Adjusting entries are made at period-end for accrued expenses, depreciation, and deferrals. By consistently recording journal entries for each financial transaction, businesses can ensure that all financial data is accurately captured and organized for subsequent processing.Posting to the Ledger

According to the GAAP accounting cycle, the ledger posting step involves transferring journal entries from the general journal to the corresponding general ledger accounts. Each transaction affects specific accounts classified as assets, liabilities, equity, revenue, or expenses. The posting process ensures that all financial activity is accurately recorded and categorized. Debits and credits from journal entries are posted under the appropriate account headings, maintaining the balance required by the double-entry system. The general ledger acts as the central repository for financial data, allowing a business to track its financial position and prepare reports. Periodic reviews and reconciliations help identify discrepancies and ensure compliance with GAAP. This step provides the foundation for the trial balance, which verifies the equality of total debits and credits before financial statements are generated. Maintaining an accurate general ledger is essential for financial transparency, decision-making, and audit readiness.Conclusions

Bookkeeping plays a crucial role in the GAAP accounting cycle, which structures the recording and reporting of financial transactions. Bookkeepers handle key steps, including recording transactions in journals and posting them to the ledger, following the analysis of source documents, and adjusting entries. The “Analyse Source Documents” step ensures financial records are reviewed, categorized, and verified for accuracy for entry to a journal. Also, some transactions lack physical documents and require adjusting entries. The ledger posting step transfers journal entries to the general ledger, ensuring organized financial data for reporting and compliance.